Accounting Specialists - Ready To Handle Your Records

Many small business owners simply lack the time, understanding, or tools to maintain proper accounting records. Luckily, financial guidance and understanding are part of our monthly accounting services. You can simply entrust your typical financial transactions— check stubs, deposit slips, statements, revenue sheets, and other records to us, and we will handle all your financial record-keeping.

Tax Services :

- Corporate income tax returns (C and S Corporations)

- Partnership income tax returns (LLCs)

- Individual income tax returns (sole Proprietorships)

- Not-for-profit organizations

- Estates, trusts & gifts

About Us

Charles F. Allia Accounting. P.A. started as a father/daughter team that has been in business since 1990.

Chuck is well known in the community for his friendly, outgoing demeanor and has earned an excellent reputation locally for his family first oriented business.

Chuck and Andrea would be happy to go on and on about how happy their clients are and how so many have benefited from their services. But modest as they are rather than toot their own horn, they are happy to let you hear what their clients have to say:

Testimonials

“When I first opened for business in 2009, I filed my own federal tax return. Never Again! I have let Charles F. Allia Accounting handle all of my business bookkeeping, accounting and tax filing ever since. They have freed up hours of my time every month so I can do what I’m best at and generate more revenue for the company. I have complete confidence that everything will be handled properly, on time and to my advantage. They take care of it all! Their knowledge of the latest tax law has saved me way more than the very reasonable fee they charge. I have recommended Chuck and his amazing staff to many of my friends and colleagues, and I always get great feedback from those who choose to let them handle the books!”

Bonnie Sue Bedell, PresidentWorthy & Company, Inc.

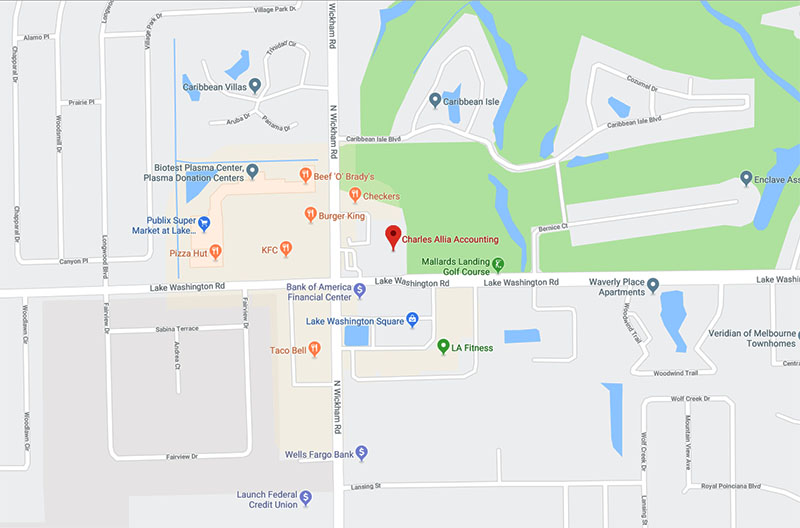

1869 Sarno Access, Melbourne

Melbourne, FL 32935

“Prior to Chuck and Andrea I had notices from the IRS. Now with their help I am current and informed of the many tax laws affecting my business.”

Rosemarie Buseby, OwnerBuz’s Automotive

1761 N Wickham Rd

Melbourne, FL 32935

“I needed help understanding how to setup my business. Chuck sat down with me and explained several options, helping me get started. Since then, Chuck and Andrea have been only been a phone call away, offering valuable guidance. 5 years later, I'm so happy with the help I've received, I'm still recommending them whenever I can!”

Marie Saccomanno, OwnerAt Your Service - Professional Organizers

www.organizflorida.com

“They come to my place of business and bring me everything I need. They save me time and money.”

Craig Heusinkveld, PresidentCraig’s Auto Service

60 Sunset Drive, Ste K & L

West Melbourne, FL 32904

“Fast, friendly and accurate service. Whatever is needed they provide on time. Very flexible.”

Dina Smith, PresidentExpress Signs

1558 S Wickham Rd

Melbourne, FL 32904

Tax Services - Planning and Preparation

Every year, Congress changes the tax laws. Each variation seems more confusing than the last. It is too easy to overlook deductions and credits to which you are entitled. Even the use of a computer is no substitute for the assistance of a professional tax preparer.

We are committed to making the continual investment of time and resources in professional continuing education to understand all the changes so we can provide you with correct information in a timely fashion.

We keep current on all the latest tax legislation and will work to minimize your current tax liabilities and be proactive in reducing future liabilities. Our technical infrastructure is state of the art and provides you with accurate and efficient tax preparation. We generate returns for all fifty states and all major entities, including:

- Corporate income tax returns (C and S Corporations)

- Partnership income tax returns

- Individual tax returns (Sole Proprietorships)

- Not-for-profit organizations

- Estates, trusts, and gifts

President

President and Your Tax-Taming Superhero (Who Happens to Be an Accountant)

With over 30 years of experience wrestling numbers into submission, Chuck is the go-to guru for individuals and small businesses.

Think of him as your financial Obi-Wan Kenobi: wise, witty, and always one step ahead of the IRS.

So, what makes Chuck so special? Well, for starters, he's like the Michelangelo of tax returns: he can sculpt a masterpiece out of even the most mangled pile of receipts.

He's also a walking encyclopedia of business smarts, especially when it comes to start-ups, trusts, and estates. Basically, if your finances are a tangled mess of Legos and Play-Doh, Chuck is the only one who can turn it into a functioning rocket ship (or at least a halfway decent tricycle).

But beyond the brains and brawn, what truly sets Chuck apart is his personality. This guy is a less stuffy accountant, more laid-back life coach with a sprinkle of mad scientist. He has a way of teaching you so that you have a better understanding of the entire tax process.

Chuck is a proud father and grandfather. He and his bride Donna have been married for over 55 years and they love to laugh, travel, and explore this world together.

Vice President

Andrea is the Vice President of Charles Allia accounting. What this means for this small company is, she does it all. From Accounting to Zeroing-It-Out and everything in between.

When Andrea earned her degree in 2001, she started helping her dad while he was still working out of his home in 2002. Together, Chuck and Andrea moved the business out of the house to where they are now.

Andrea prides herself on accuracy and saving people money. She knows the ever-changing tax laws can be frustrating. By keeping current with continuing education, she can understand and implement the tax laws so that you don’t have to.

Andrea feels fortunate to work side by side with her father daily. This is apparent when you walk into the office and can hear them joking and teasing each other. In her free time, Andrea likes to relax with her husband and daughter. Family time includes spending time at the beach, traveling, trying out new restaurants or just snuggling on the couch with their kitty watching T.V.

Tax Specialist

Kathleen is originally from Long Island, NY and is our financial administrator. She has had her degree in accounting for over 10 years and helps us with bookkeeping, accounting, and tax returns. She specializes in Foreign Expat returns, Foreign Earned Income Exclusion and Federal Income Tax Case History and Rulings. She loves a good challenge of an unusual case and approaches all matters with compassion and mindfulness.

As a mother to 4 and grandmother to several, she knows the importance of family first. In her free time, Kathleen can be found at her happy place, the beach. The beach and the ocean are where she goes to recharge her soul.

Office Manager

Julie is the face that will greet you at the front door, or maybe you’ll just hear her voice answering the phone when you call in. Julie is here to support Chuck and the gang with all aspects of the office workflow.

She grew up in the greater Seattle area where she was an emergency 911 dispatcher for 2 decades. When it was time to hang up her headset, she joined her husband Brian as a Realtor until they retired to sunny Florida where Brian was born & raised.

Julie and Brian have 5 children scattered across the country, several grandchildren and 1 adorable puppy. They love to spend their free time lounging in the sun, floating in the pool, and traveling.

Accounting & Bookkeeping Services

Meaningful, well-organized financial records ensure that your business operations will run more efficiently on a daily basis and minimize both current and future tax liabilities.

Many small business owners simply lack the time, understanding and tools to maintain proper accounting records. Luckily, financial guidance and understanding are part of our Monthly Write-Up Service.

You can simply entrust your typical financial transactions— check stubs, deposit slips, statements, revenue sheets, and other records to us, and we will handle all your financial record-keeping. Our Monthly Write-Up Services include:

- Prepare Form 941 (Payroll Tax Return)

- Year end W-2's, W-3's, Form 1099-Misc & 1096

- Bank reconciliations for each bank account

- Balance sheet statement of assets, liabilities, and owner's capitals

- Profit and loss (P&L) statement

- Payroll register showing information on all employees

- Unlimited consultation to help you understand your financial information

- Prepare sales tax returns

- Prepare state unemployment tax returns

- Conduct workers compensation audits in our office

- Assist in sales tax audits

Tax Cutting Checklist

Whether you’re a wage earner, an investor, a business owner, or all three, you should use the tax-cutting benefits available in the tax law. There is little to be gained by paying more tax than the law demands. Identify the tax-savers for which you qualify.

Here’s a tax-cutting checklist to get you started. Check the list to see if there are tax breaks that you are overlooking:

- Roth IRA

- Rollover to Roth IRA

- Tax-deductible IRA

- Child tax credit

- Income shifting to children

- Child care credit

- Earned income credit

- Education savings accounts

- Education expenses

- Hope scholarship credit

- Lifetime learning credit

- Bunching deductions

- Flexible spending accounts

- Health savings account

- Donating appreciated assets instead of cash

- Best filing status

- Shifting income or deductions from year to year

- Adoption expense credit

We can't change the tax laws, but we can make sure your records are in order, that your returns are completed on time, and that you receive all the deductions to which you are entitled. With proper tax planning, we can help you lower your tax bill.